Ergodicity: What Does It Mean?

Why the difference between ensemble and time averages matters for investing and risk

During my time in banking, there was one particular deal that fascinated me due to its cleverness: GoPro’s convertible issuance in 2017 April . Matt Levine writes about it here, my summary is below:

If your company is doing badly, it can be hard to get debt or issue equity

A convertible note might be a great option since convertible arbitrage investors (Arbs) want volatility. Your stock price decline has probably created significant volatility

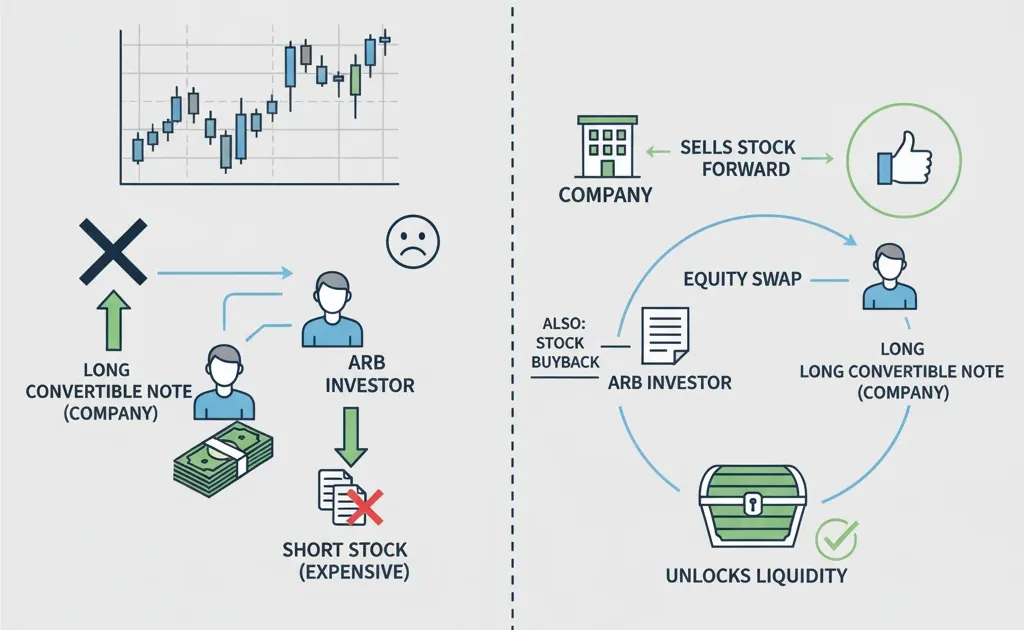

Arbs go long the convertible, and short the stock to hedge the equity exposure

But your company probably has a lot of short sellers already. This can make short selling expensive

If shorting is expensive, Arbs won’t want to play, and you won’t get enough investor interest

The solution is to let Arbs short the stock to the company (rather than on the market) through derivatives

The downside is you spend money on the forward contract buying back stock, so you don’t get the full convertible raise

The company is effectively selling a convertible and buying back the stock price risk, leaving investors with volatility risk

Get my next essays in your inbox:

Comments