Community as a Concept

CAC to lower your CAC

I recently job shadowed Bilyana Freye of the job shadowing marketplace Hoppin, below is an inital take on my experience.

Full disclosure: My company paid for this activity as part of a professional growth learning budget 1

Whenever people are looking for a new job, a common piece of advice is to first do their research. Some ways that people currently do that are by doing internships or by asking others currently in that role. Internships are a heavier time commitment and not always feasible, whereas talking to current employees doesn’t get you information as rich as actually experiencing it during an internship. This is the gap Hoppin is trying to fill.

Hoppin is a job shadowing marketplace, trying to connect people interested in shadowing someone for a day with someone willing to host another person for a day. Ideally, both sides can benefit from this. The shadower gets an authentic ‘day in the life of’ experience that gives them a much better idea of the role, and the host gets new perspectives on their role and potentially a new hire. I can see why people would be interested, and now finding how to make a business out of this is the key problem to solve for Hoppin.

I’ll start off describing the booking flow, then my personal experience, and end with thoughts and feedback on the company. The takeaway is that I thought it was an awesome experience and worth checking out, subject to the caveats I’ll mention below.

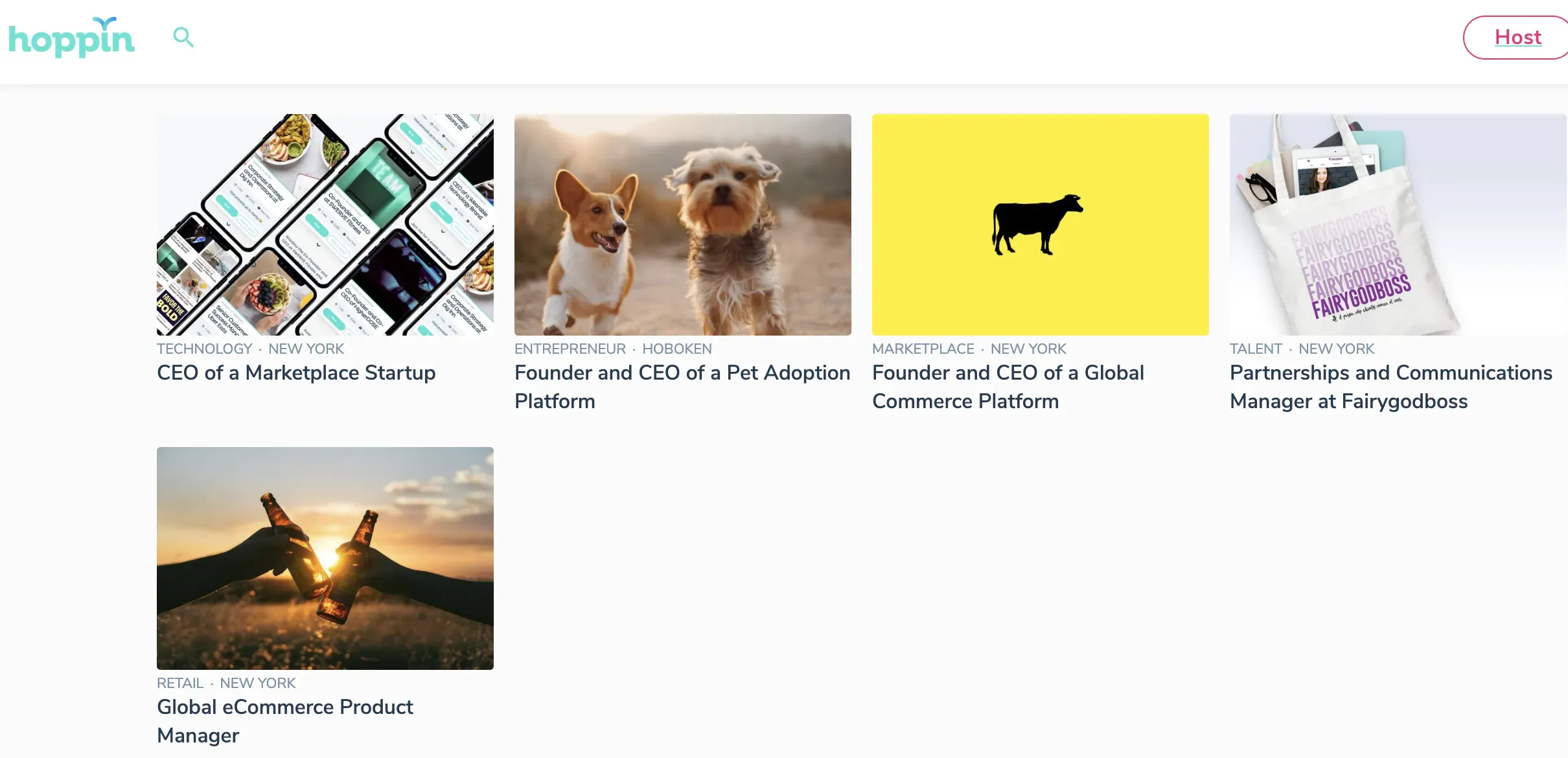

The site has search functionality to let you browse for experiences in your area of interest. The example below was when I was at the end of the search results for “marketplace”. Just look at that corgi.

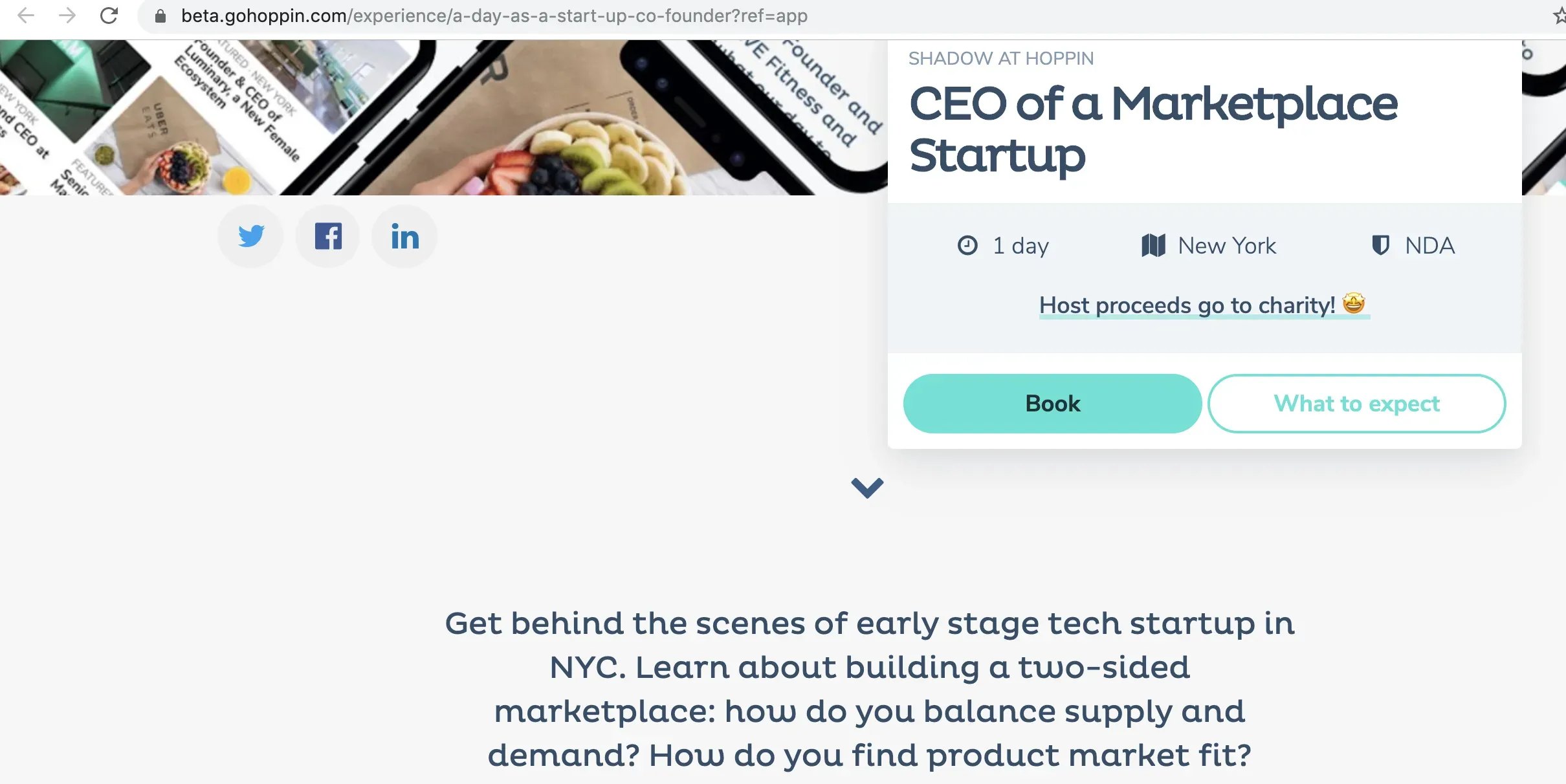

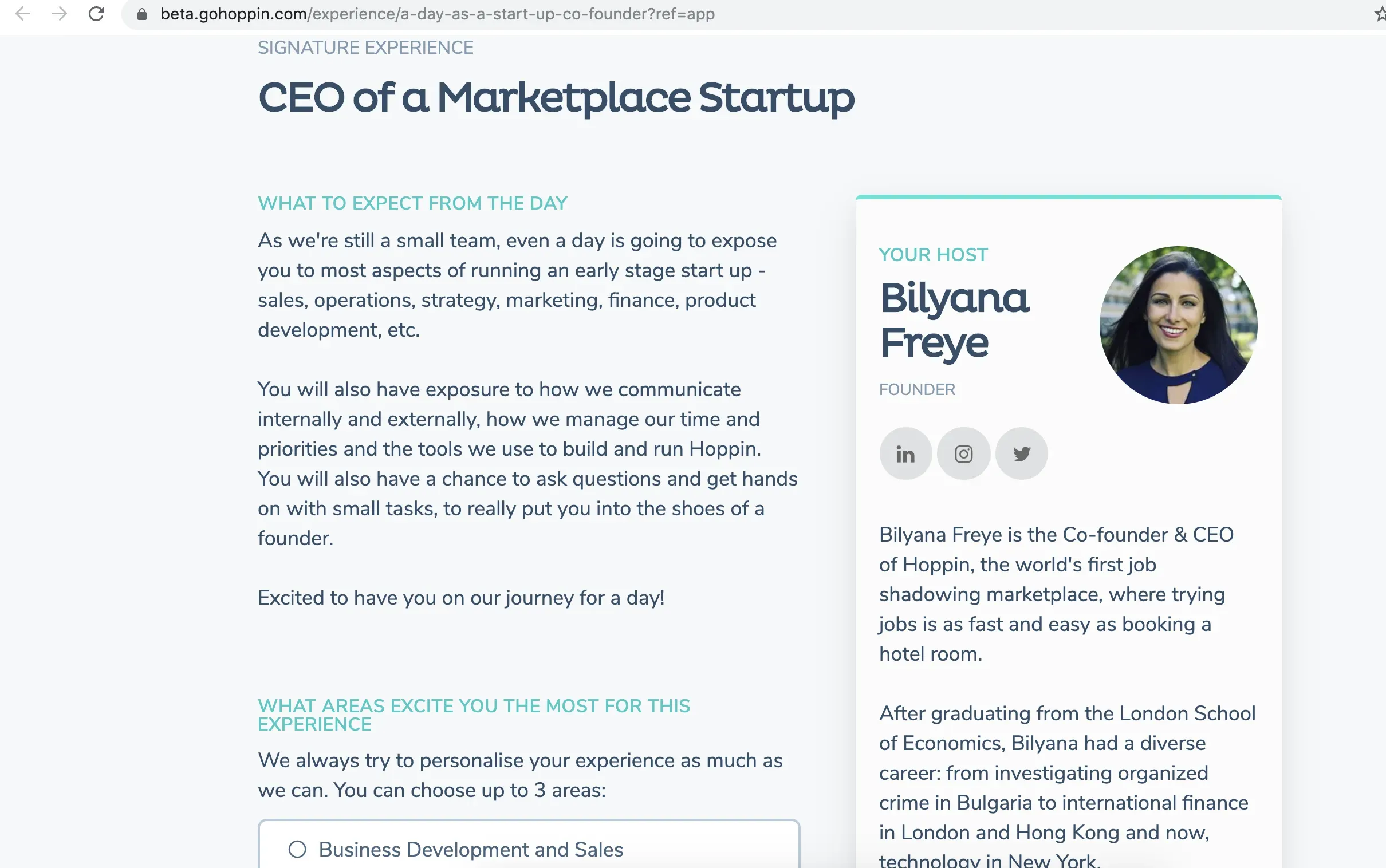

After choosing an experience you’re interested in, you’re brought to a profile of the person and the experience. In this example 2, you can see brief info about the role, duration, location etc above the fold, and then more details below it.

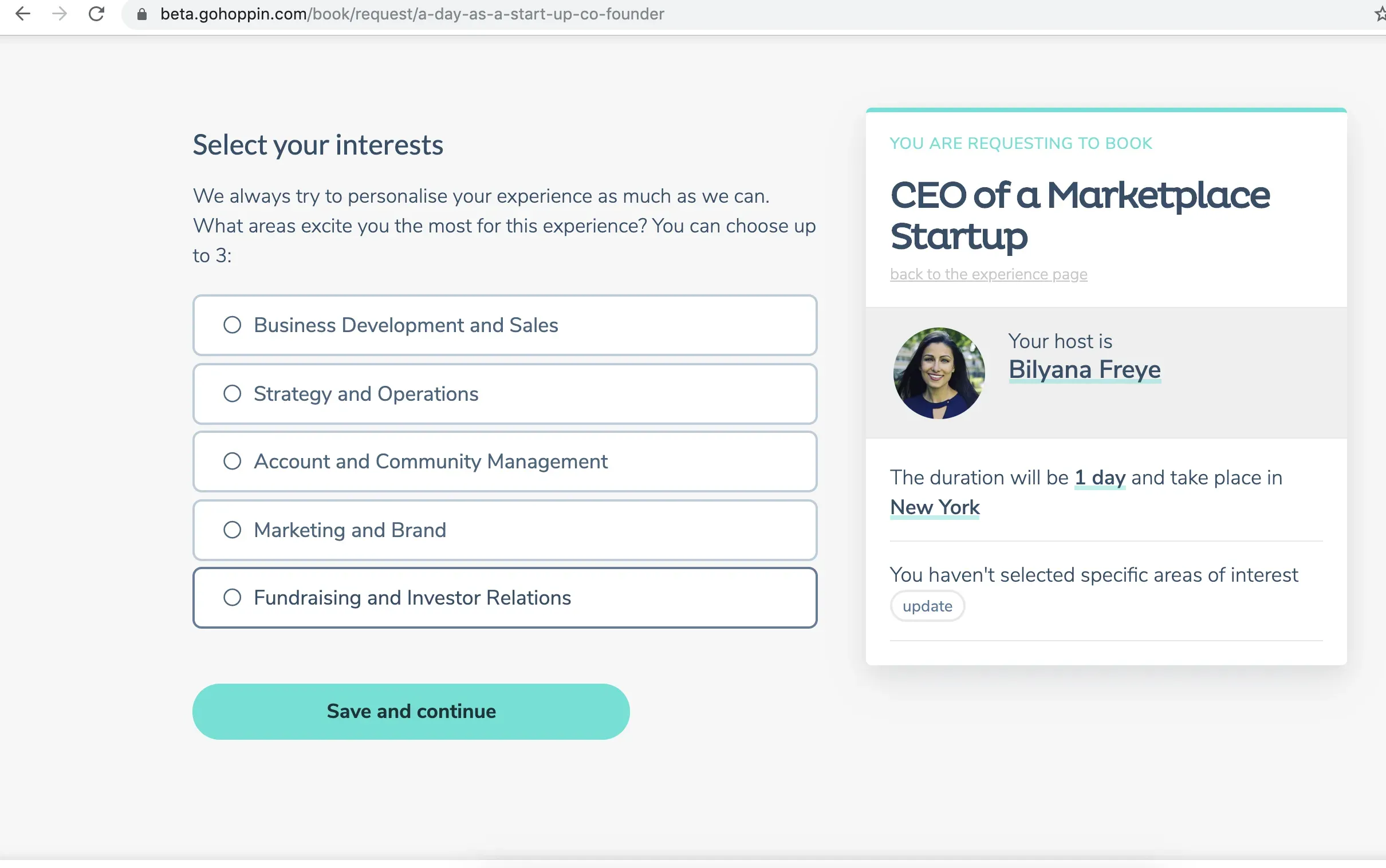

After you click through to book, you can select your interests from a prepopulated list, which was provided by the host when the host was setting up their own account.

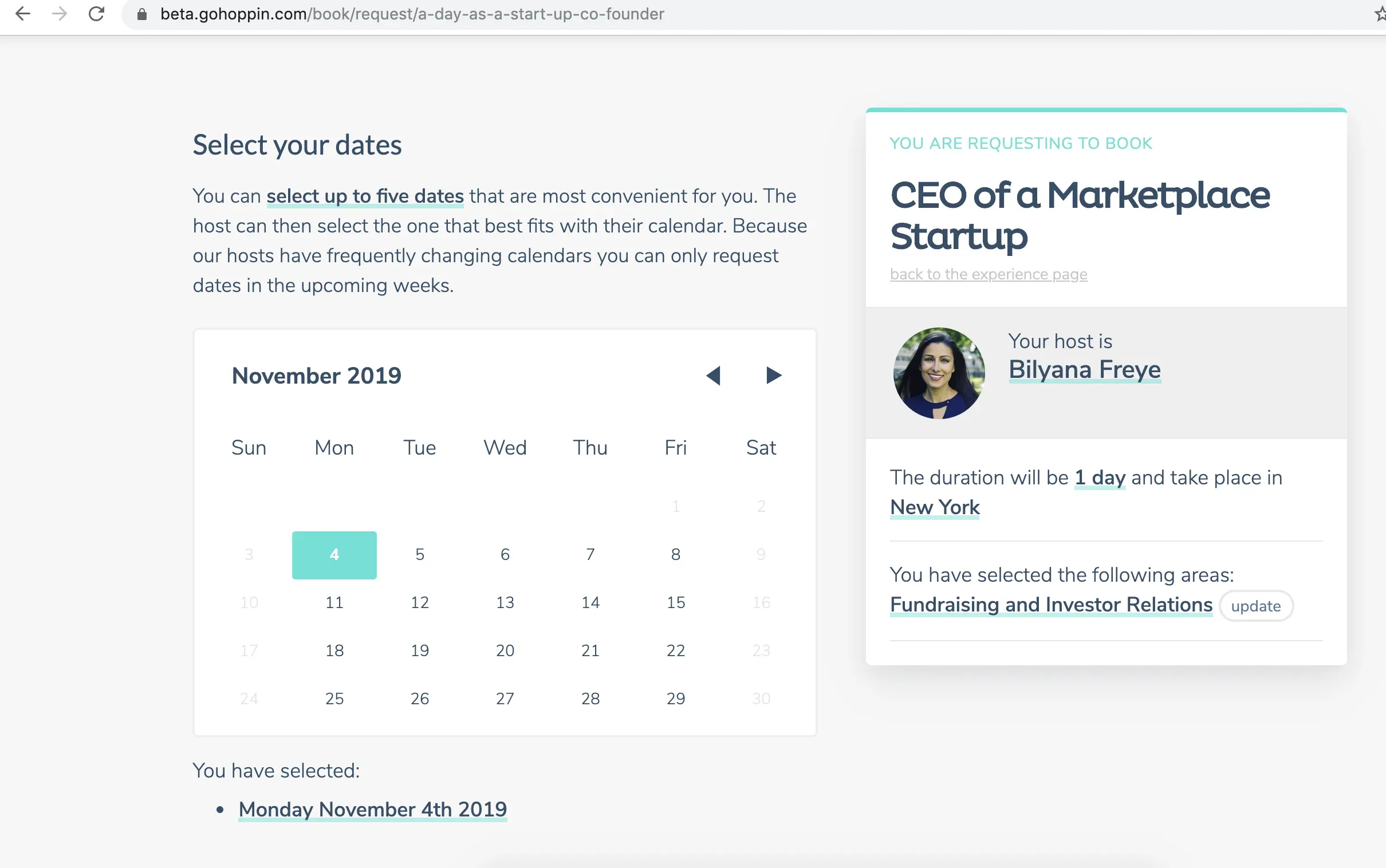

You then select dates that work for you:

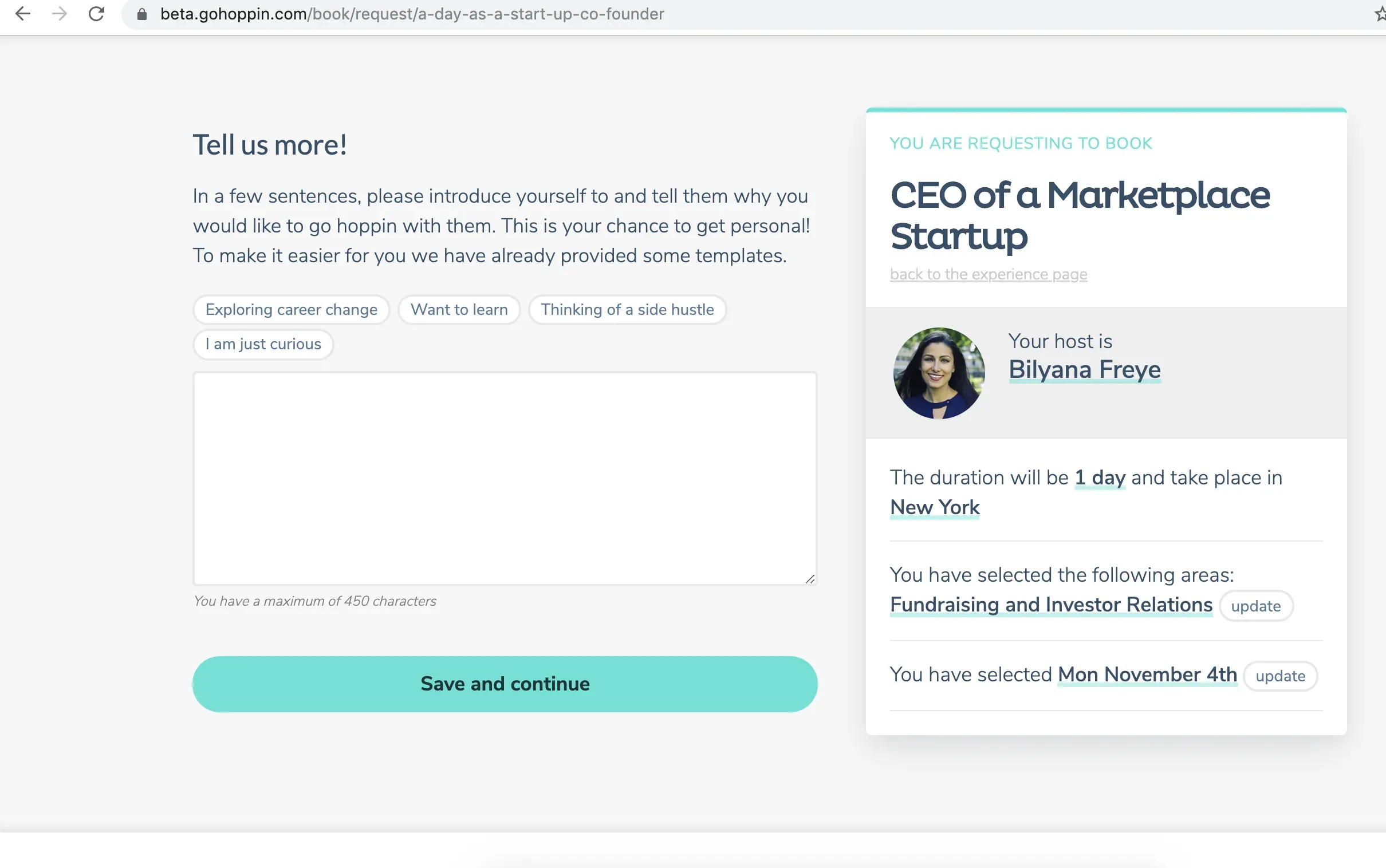

And you can give free-form responses about your intent after that. Side thought - perhaps this can be combined with the ‘select your interests section’? Seems to be of similar purpose

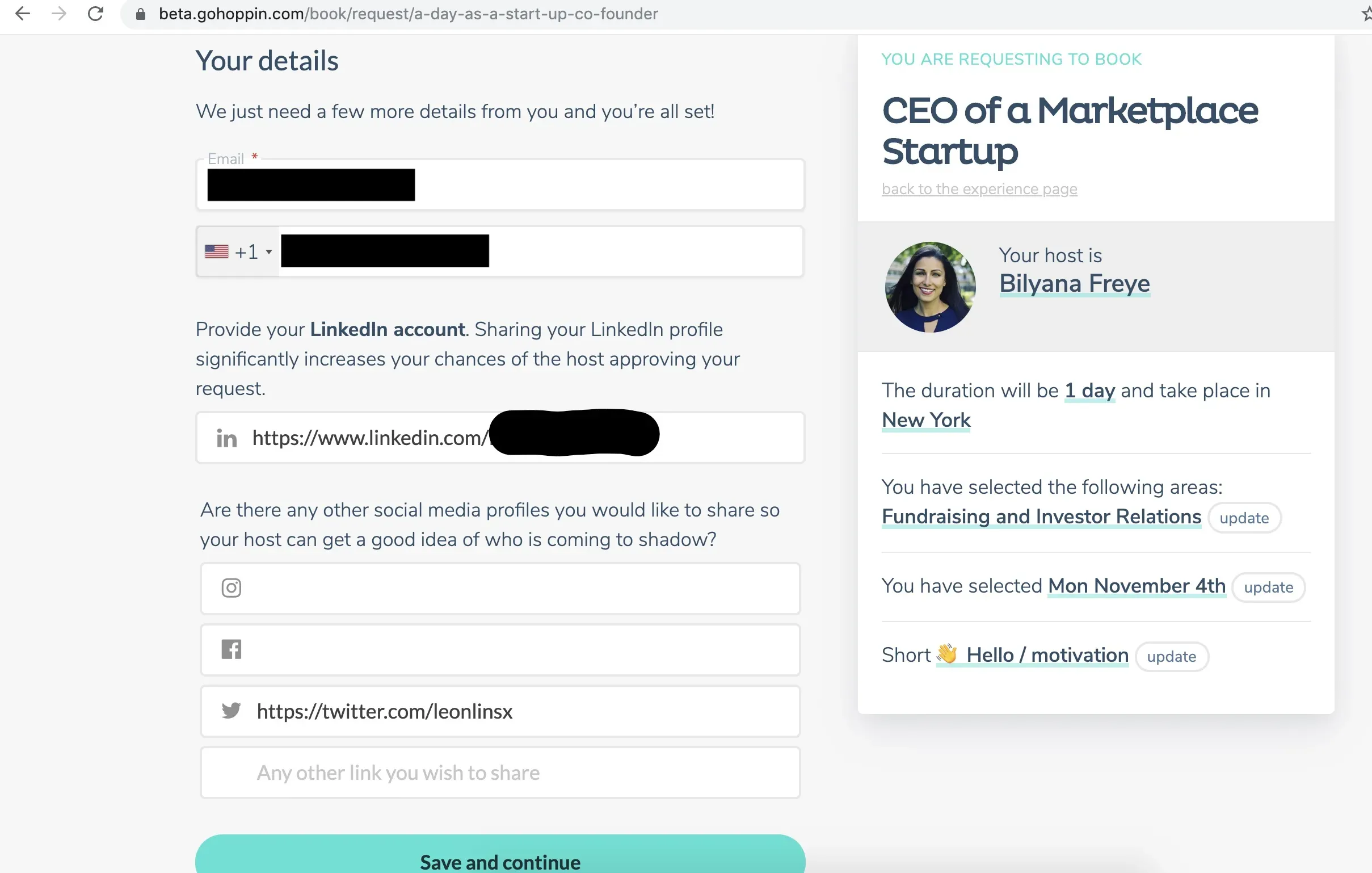

The next step is to fill in your contact info and any other social media profiles you want to link. Here you see that for convenience they’re pulling in info that I’d previously filled in my profile already.

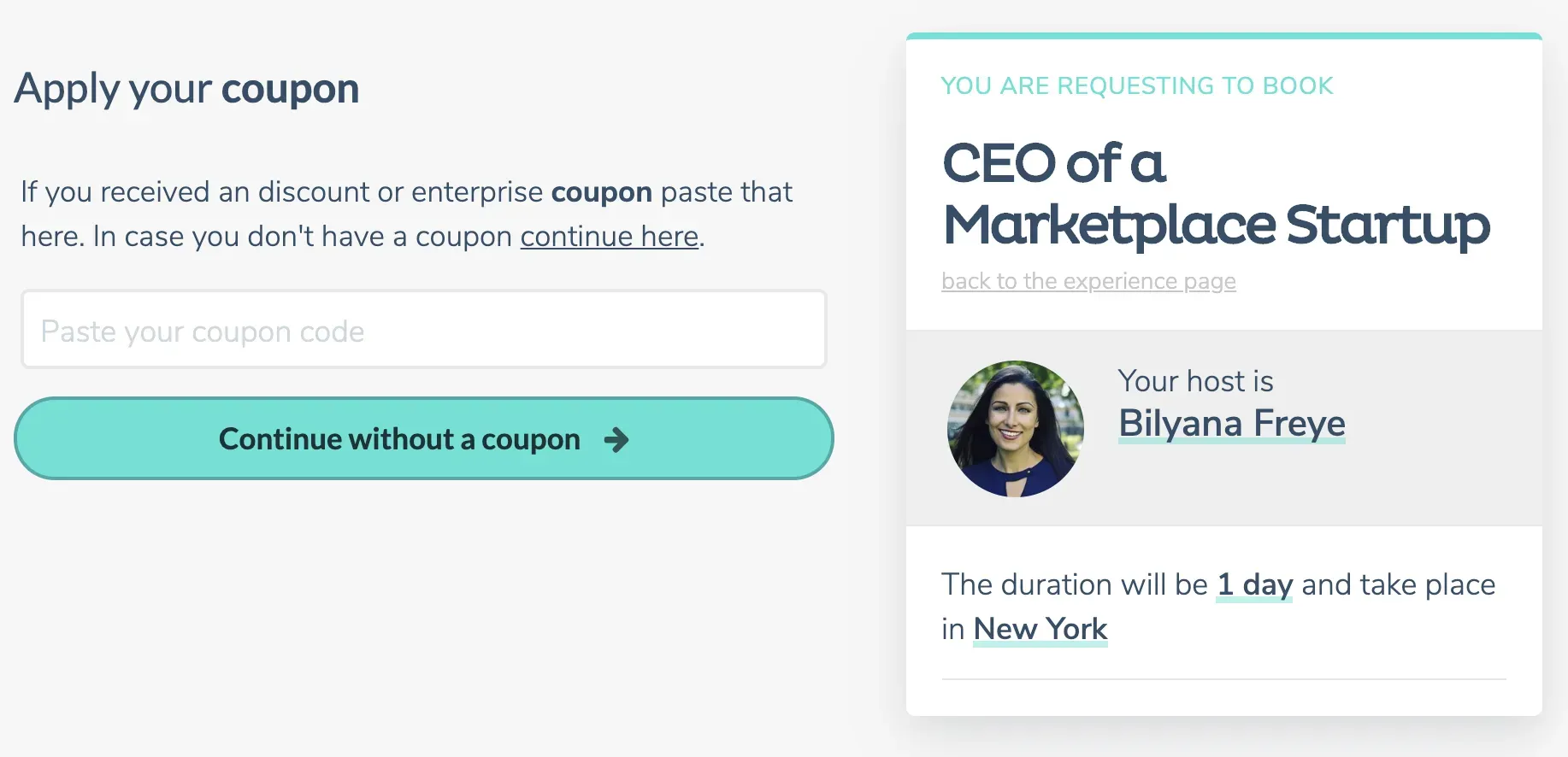

Hoppin is trying to pivot to B2B, hence this next step of coupon application. It wasn’t there when I initially made my booking a few weeks prior. I’m assuming that applying the coupon takes you to a slightly different flow than what I’m next describing; probably straight to a confirmation page?

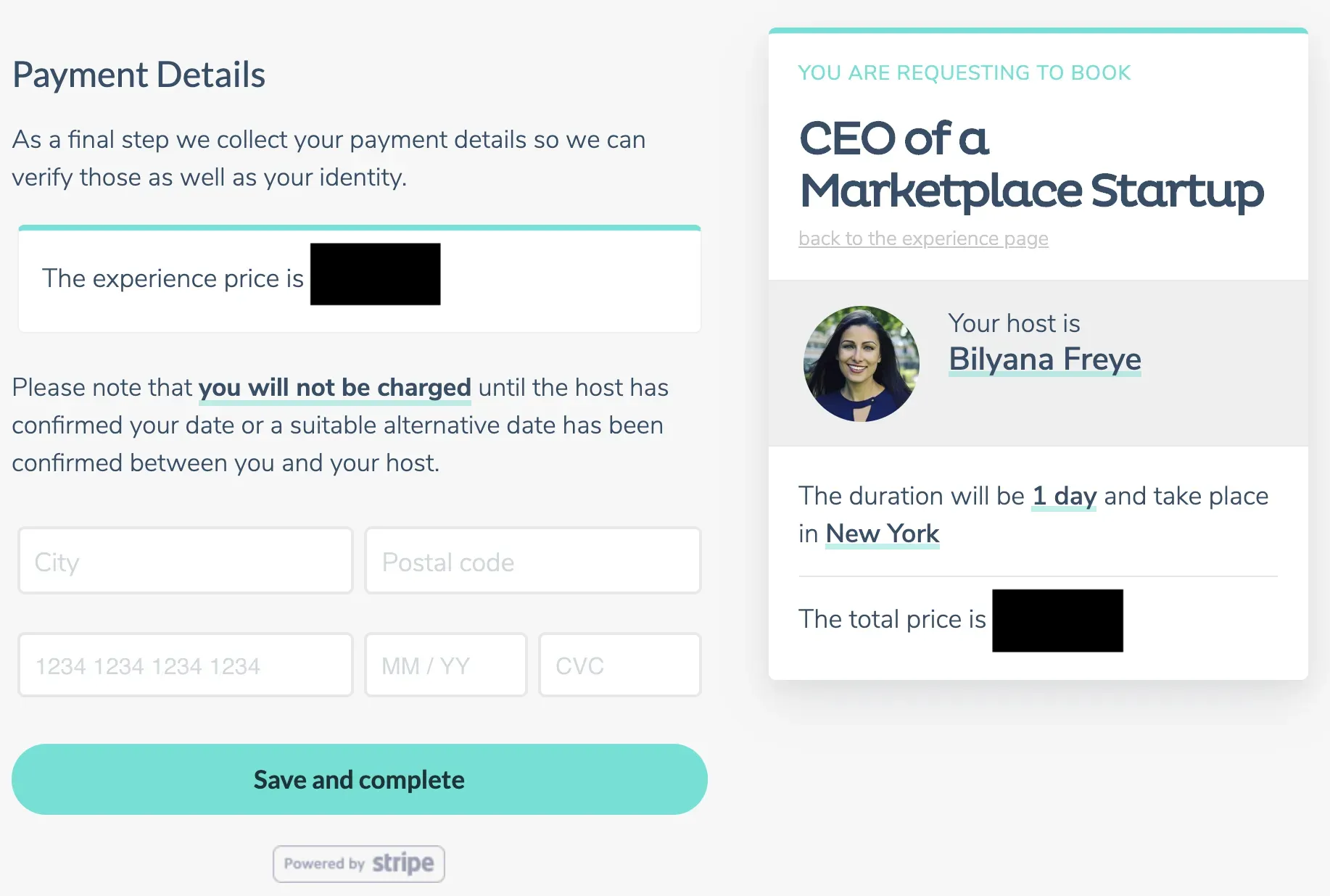

The final step is payment details. I’ve blacked out the numbers here since they’re still working on pricing. I personally would prefer seeing the price upfront, on the experiences page itself, but can understand why it’s here in the flow

You get a confirmation email after the booking, and supposedly a receipt as well 3. After that, they send a reminder email the week of, and also an email prompt the day of to nudge you to share your experience.

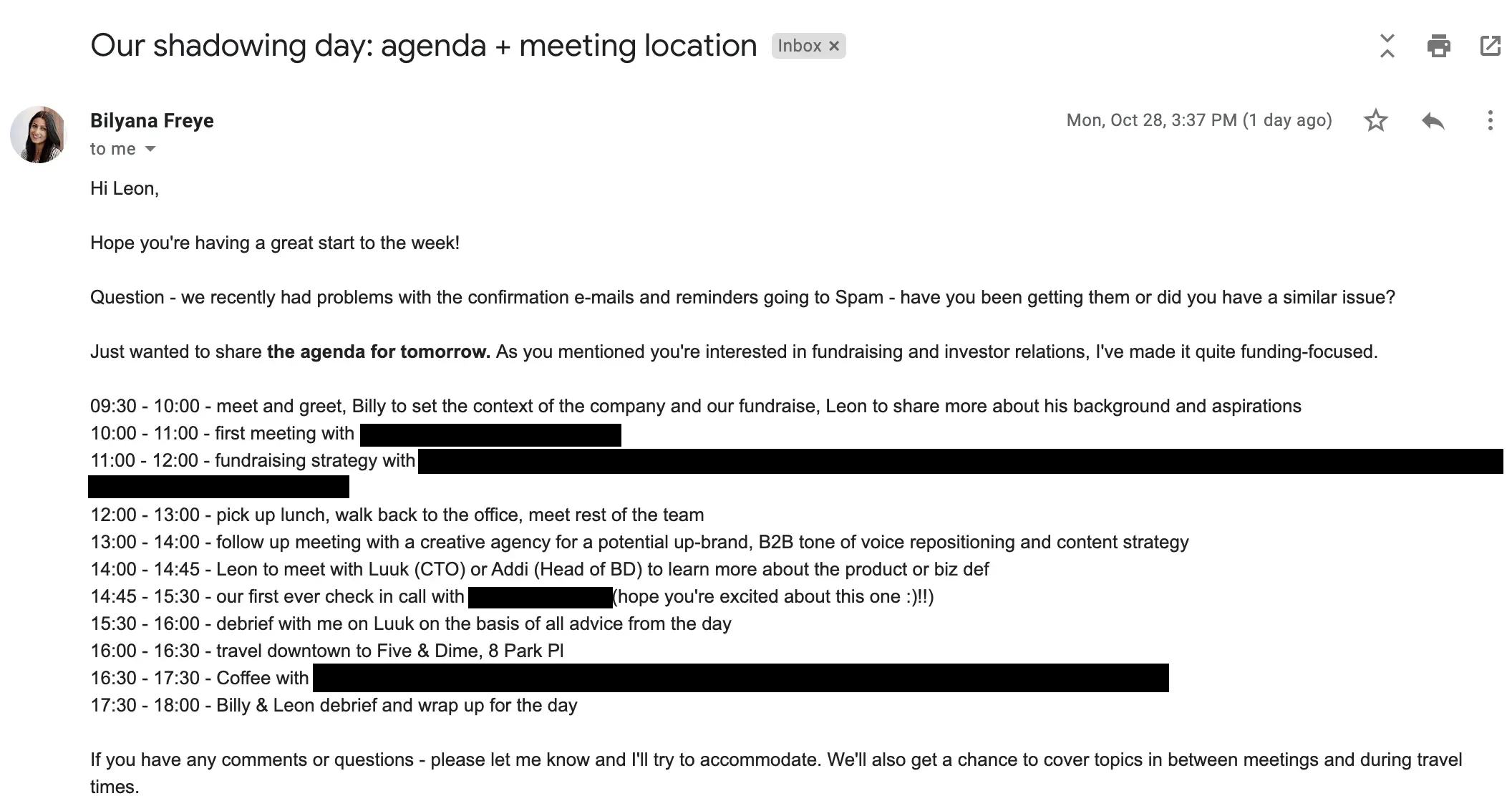

In addition to that, I also got an email from my host (Bilyana, the founder) with my agenda. I found this helpful to ease my concerns about what to expect 4. I also thought it was awesome that she’d clearly arranged for an experience that fit what I was interested in. The Hoppin team mentioned they’re intending for the host to reach out first since the host is getting paid; the team intends to make that more obvious to the hosts moving forward.

I met Bilyana at a cafe in the morning for an introductory chat. We talked about our backgrounds 5 and she gave a quick overview of the company, noting that the investor meeting right after this would likely let her elaborate in more detail.

Hoppin is currently fundraising, so we met with a potential investor right after. The investor gave their background, heard the pitch, and asked questions regarding:

Which I felt were all thoughtful questions I’d have been interested in as an investor as well.

After that investor meeting, we joined up with Bilyana’s cofounder Luuk Derksen to meet with the accelerator they had partnered with. The Hoppin team wanted to get advice primarily on fundraising and handling investor relationships. One topic in particular I had a strong opinion on - the frequency of investor updates. In my experience on the public market investing side, a company stopping a regular update or pulling metrics is usually a bad sign. You stop talking about stuff when things go bad, but that’s exactly when you need to talk about it the most. Many times private investors could have helped had they known about a company’s issues earlier, but were only looped in when things have imploded. Carta has a sensible investor update format. For any founders reading this, please keep doing your investor updates.

We picked up lunch (Hoppin paid), and then met with a creative agency to chat about how Hoppin could benefit from the agency’s services. The agency talked about what they could do to help positioning, business design, and digital branding. We also discussed what the marketing message, company identity, and issues in closing the sale were. The meeting ended off with both sides agreeing on follow up items. I personally thought it could be premature to work with an agency at this stage, but obviously will defer to the founders’ judgement in running their business.

I then met with their head of business development, Addi for a bit. She walked me through her sales funnel, explaining how she used her tools to prospect and follow up with potential clients. Addi described her tactics to get higher engagement rates, a simple example being that she would tailor the copy to the person, since a startup would have different goals compared to an enterprise. Addi also attends multiple events outside of work to meet and pitch Hoppin.

We then had a catch up call with a current investor, which covered:

I found the meeting pretty standard based on my experience on the public markets side and knowledge of the private process. The Hoppin team was candid about both their wins and their losses, and got good advice on how to approach the next few weeks 6.

We were initally supposed to have one meeting downtown with a journalist, but that was postponed, so I ended up having some free time. We filled that up by doing a Q&A session with Bilyana, and then walking through the product with Luuk. During the product session we talked about:

I was supposed to work on a small task as well, but had to cut that due to the two sessions above taking longer than expected. I hear the normal expectation is to have the shadower work on something in order to increase engagement. There was one more fulltime member of the Hoppin team (Abi?) that I unfortunately didn’t get to spend much time with, but that was to be expected. I was shadowing one specific person and not the team after all.

We ended off with the planned debrief, which ran past our original ending time due to the comments I had. It was a long and busy day for everyone. Appreciate the Hoppin team staying even longer for the shadowing experience!

The Hoppin team told me they’re aware of the above issues.

I loved the experience spending a day with someone working at a marketplace company, and it was enhanced by having many activities that I was personally interested in. I think the pricing is high for a retail consumer, but it would make sense for a B2B HR resource. If Hoppin can pull that pivot off and expand the supply side of their marketplace, they’ll be interesting to watch in two year’s time.

Also, Hoppin bought me lunch and coffee. I’ll leave you to decide if that affects my objectivity… ↩

I forgot to take screenshots during my actual booking, so these are mostly a re-creation ↩

Might have been a bug during my booking as I didn’t get my receipt. Hoppin told me they’re looking into it. ↩

I’ve edited out details in the agenda for confidentiality ↩

You can read more about her background here. And obviously you can read more about me here ↩

The investor also didn’t get too in the weeds about how to operate the business, which is in my opinion a sign of a good investor. Unlike someone who might offer advice on where to combine parts of your booking flow. ↩

Not mentioning these for confidentiality since they’re still building them out ↩

Contingent on getting the pricing right, and that depends on how they pull off their B2B pivot. ↩

Get my next essays in your inbox:

Comments