What is art

Different definitions of art over history

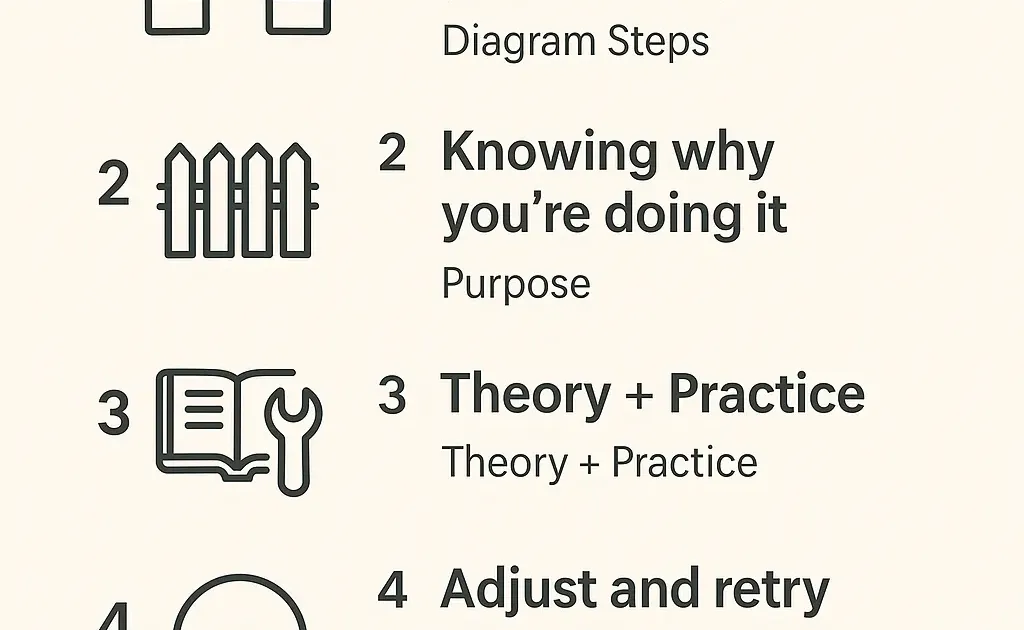

Improving your process involves mapping out the steps, knowing what to include or exclude, having both theory and practical experience, and repeated experimentation

We started out the month looking at art, and there’s a reason for that. Art is high skill, low luck. While it’s possible to create great art without much skill, most art is crafted intentionally. Since you start from scratch, every element is there for a reason. We saw this in Manet’s “unpolished” depiction of modern life, Dominique-Ingres’ “unrealistic” body shape, and Picasso’s “ugly” drawings, where weird features were the point of the painting and what looked natural was manufactured deliberately. Throughout these, the artists followed their own deliberate process to get consistent results.

Another thing on my mind this year was process improvement, or “getting better at getting better.” Here’s why:

Getting better at something - that’s a process.

Getting better at getting better - that’s one more layer of abstraction and can be harder to think about, but is also a process in itself.

One other reason it’s difficult is that processes are intangible. You can depict them in some flowchart, but most people prefer judging the visual outcome over the invisible process. Telling someone “I made $1mm” sounds better than “I improved my prioritisation criteria so that I only took high expected value clients.” We’re judged by key performance indicators, not key process indicators.

And yet another reason is that the beginner usually has no idea what they’re doing right or wrong, and don’t even know what they don’t know. There’s always that initial stage after you’ve gotten comfortable with a new activity, and start feeling you’re pretty good at it. It takes much longer to realise that there’s much deeper expertise in every field, from art to investing to slicing lox for bagels. Reading profiles on Weird Al or Jerry Seinfeld can show you how much thought goes behind every word they use.

Over the long run though, process wins out. Luck will average out 2, and you’re left with the output of your process and skill. If your process is bad on average, you will be bad on average.

We’ve seen suggestions on how to improve processes in an older article this year. Some additional thoughts I’ve had:

Starting from the basics, you need to be able to diagram all your steps. If you don’t even know what you’re doing you can’t consciously choose to work on anything.

For example, if you want to be a better investor, you need to note down all the steps involved from your idea generation to exit trade.

The idea behind Chesterton’s Fence is that if we see an object and don’t understand its purpose, we should acquire that understanding before removing it.

And if we recall what we learnt from art, we should also know the purpose of something before including it. The point here is to be deliberate.

To continue the investing example, if you’ve always included “due diligence call with someone in industry” as part of your process because that’s what’s “standard practice,” it’s worth thinking about why you do so.

People argue about the importance of theory vs practical all the time, and it’s usually an unproductive discussion. More hands on experience will make you better. More theoretical knowledge will also make you better. If you don’t practice you can’t get better. If you don’t know the rationale behind why you’re practicing, your progress will be slow or nonexistent; you’ll plateau without knowing what’s holding you back. Nobody argues about whether your left leg or right leg is more helpful for walking.

For the investor, you’ll never make money if all you do is read finance theory and don’t actually put money in the market. However, if you don’t understand how professional investing works and the informational edge that institutions have, you’ll also get blown up 3. Probably without even knowing why.

You’ve now looked over all your steps, known why they’re there (or deliberately excluded), and identified any possible gaps. The next step is then to make small adjustments deliberately, and track any changes over time. If you’ve done all this work but don’t record it down, you’ll never hold yourself accountable.

Notice I said next, not last step. I’ve mentioned this before, and getting better is never a one-off process. It’s tough to keep staying on track with reflections; most people prefer just doing stuff compared to recording and evaluating. But if you don’t, you’ll also get stuck.

For example, if you’ve realised that your scenario analysis for investment ideas is consistently too bearish, causing you to sell too early, you should make small changes to your risk evaluation and see how well that works out for you. Importantly, you need to have a record of it. If not, you’ll end up making up reasons after the event to make yourself seem smarter. The point here isn’t to seem smart, it’s to actually become smarter.

All that said, this is a tedious process, and I’m not expecting anyone to run it every day, or even every month. The more important thing is to actually do the work, rather than overthink how often to do it.

There are many games we play just for fun, and getting too good at them vs your playmates will make the game unfun. ↩

If you’re lucky all the time, I’d argue that’s not luck anymore but something systemic. It’s like how pretty people say everyone’s always friendly to them and how they’re so lucky that nice girl at the coffee shop gives them a free donut every time. ↩

Well in this market you’ll probably become a billionaire and retire while laughing at my advice… ↩

Get my next essays in your inbox:

Comments